An entity by the alias “Satoshi Nakamoto” wrote the blueprint to one of the most significant phenomena of the 4th industrial revolution; the first-ever cryptocurrency, bitcoin. Unlike most traditional currencies, such as dollars or euros, bitcoin’s code has a finite supply and a predictable schedule.

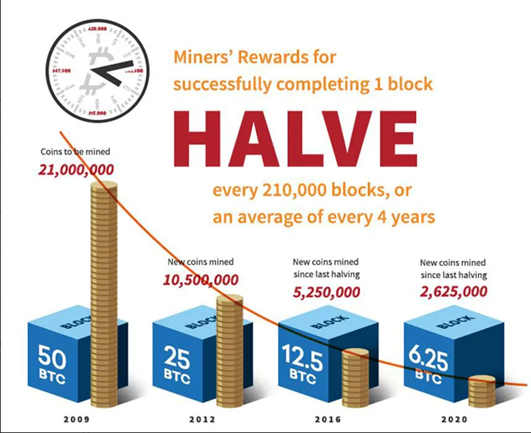

As part of the bitcoin design, there will only ever be 21 million coins. This predetermined number was put in place to keep the supply scarce, so alongside its utility, it would largely influence their market value. (Here is to the 100+ million of us hodlers who hope so)

Nakamoto’s vision was to create a system that would be self-sustaining, similar to gold mining, where shovel and sifter are replaced by CPU, electricity and sophisticated algorithms.

What is Bitcoin halving, and why does it happen?

Halving or “halvening” is an event that halves the rate at which new Bitcoins are generated.

Much like it’s physical counter-part ‘gold,’ Bitcoin aims to become more and more difficult to mine as the supply reaches its limit. Currently, there are 18 million bitcoin in circulation out of a total of 21 million bitcoin to ever be created. The halving signifies a colossal moment in the journey of bitcoin, by becoming half as rewarding to mine and cutting inflation by 50%.

As per the bitcoin protocol, one block is added to the bitcoin blockchain roughly every 10 minutes, and it looks something like this:

Each halving occurs every 210,000 blocks x 10 minutes = 2,100,000 minutes = 4 years apart.

This process will probably end in the year 2140, and once Twenty-one million coins are generated; the network will stop producing more.

Here at CoinPayments, we wish we could live to see the day!

To understand the fabric of bitcoin, it’s crucial to identify the component that ensures the security of this leaderless system: Block Rewards.

What is a block reward?

The bitcoin blockchain awards each miner for their efforts in successfully mining a block.

Each block is around 1mb in size, and it is used to store the bitcoin transaction records; This is intentionally designed to be resource-intensive and complex for two reasons:

- Be computationally impractical to modify it, thus rendering the blockchain secure.

- To ensure the number of blocks mined each day remains steady.