Major retailers like Microsoft, Nordstrom, and Starbucks are now accepting cryptocurrency as payment, as more businesses catch on. This rising trend has left many wondering: what’s behind this move, and what made them think it was a good idea?

Today, we’re breaking down the major benefits of accepting cryptocurrency payments, and why now is the perfect time for your business to do it. We’re also walking you through a step-by-step guide on how to get started so that you can see just how easy it is to start accepting payments in Bitcoin, Ether, and +120 other cryptocurrencies.

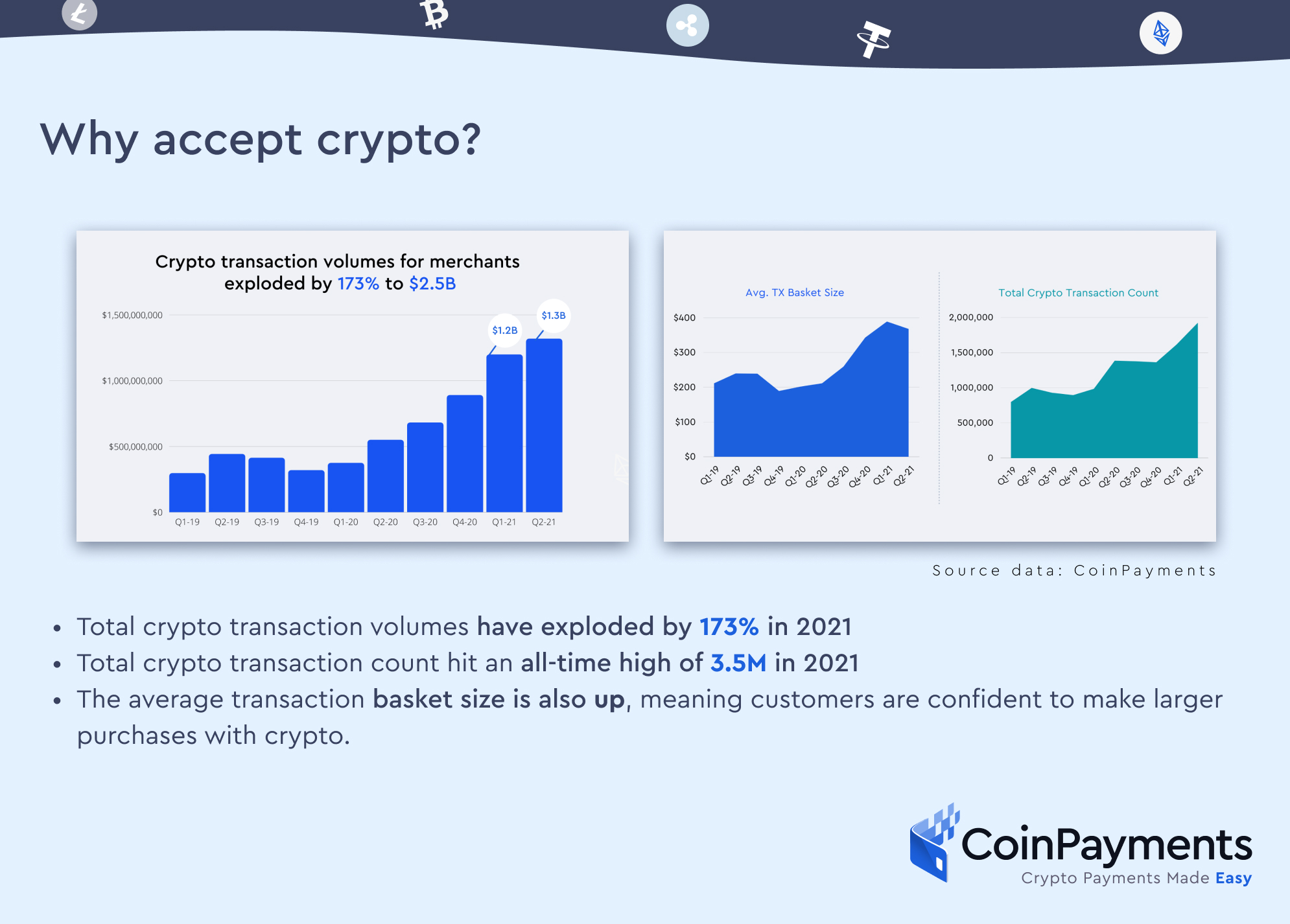

Why accept crypto?

1. Attract more customers.

One of the main reasons more businesses are accepting crypto payments is the rapidly growing global adoption of cryptocurrency. And now, this increased adoption has provided businesses with a unique opportunity to benefit. It’s no longer a matter of if cryptocurrencies will reach mainstream adoption, but when.

Here’s a snapshot of what our recent data reveals:

- Total crypto transaction volumes have exploded by 173% in 2021

- Total crypto transaction count hit an all-time high of 3.5M in 2021

- The average transaction basket size is also up, meaning customers are confident to make larger purchases with crypto.

2. Cut fixed costs.

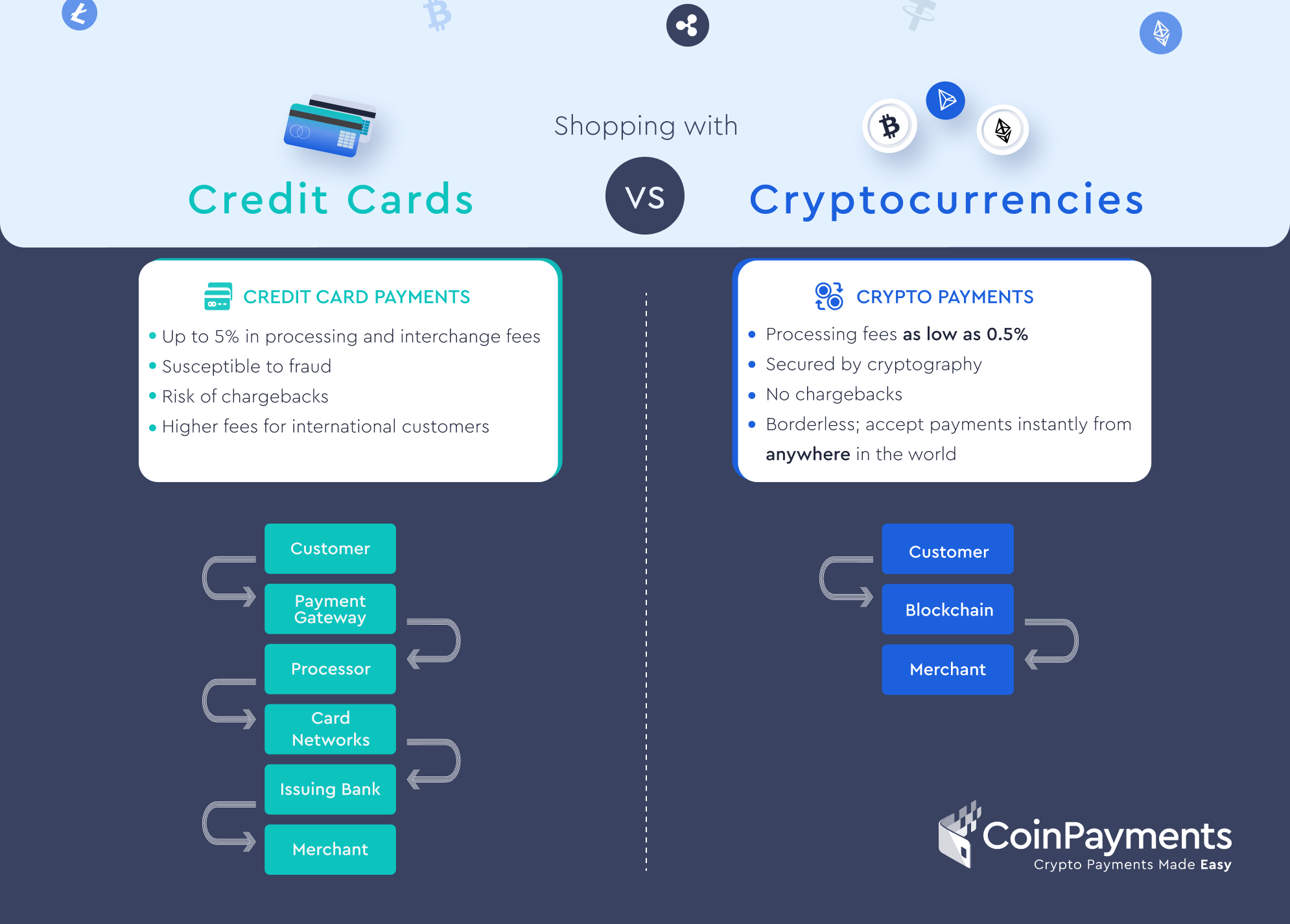

For businesses, accepting traditional payments is a necessity, however, merchants are forced to pay the climbing fees associated, like high processing costs and interchange fees. These fixed costs can be especially significant for smaller businesses, where every dollar counts.

On the other hand, crypto payments can be accepted at much lower rates, allowing businesses to retain more of their revenue to reinvest back in their business and continue to grow, instead of remaining stagnant.

3. Secure your customer data.

Cryptocurrencies run on the blockchain, a technology that uses cryptography — a method of protecting information through coding (that’s where the “crypto” in cryptocurrency comes from). Transactions on the blockchain are secured through cryptography, meaning cryptocurrency payments are far less averse to the risk of data leaks and security vulnerabilities.

Merchants that accept cryptocurrency payments are therefore better able to ensure their consumer payment data is kept secure, and going this extra mile puts businesses in a better position to attract the modern consumer, who values security over convenience in the post-COVID world.

4. Reach anyone, anywhere.

The new online marketplace can be a powerful platform for businesses of all sizes, as it has made what was once impossible, possible: it has created an entirely borderless marketplace. Because cryptocurrencies are universal, foreign exchange fees are no longer a barrier to consumers, reducing abandonments at checkout.

Furthermore, the massive underbanked population globally reveals a lost opportunity for merchants everywhere. On the other hand, spending crypto only requires that an individual has a phone and access to an internet connection, letting businesses reach a wider, more inclusive audience.

5. Eliminate chargebacks.

Chargebacks (aka unexpected refunds) can be incredibly challenging and frustrating for small businesses, but a little-known fact is that they aren’t something that merchants have to put up with.

Accepting cryptocurrency payments is one easy way to eliminate chargebacks, as transactions on the blockchain are permanent and immutable. It gives merchants the power to decide for themselves if they’d like to refund a customer for any reason, on their own accord, with due diligence.

6. Stay current.

To prepare any business for the future, merchants have to lay a strong foundation today. It all starts with making calculated decisions to adopt emerging technologies ahead of the curve. Deciding to accept cryptocurrency payments positions your business as one of the early adopters that won’t have to scramble to adapt later.

How to start accepting cryptocurrency payments for your store

If you’re convinced, we’re here to walk you through how to get started. Accepting cryptocurrency payments is easy with CoinPayments, and it’s a decision that will set your business years ahead of the competition.

So, are you ready to get started? It all depends on what eCommerce platform you are on.

If you use Shopify…

- Create a CoinPayments business account.

- Record your merchant ID, found in your CoinPayments account portal.

- Create an IPN Secret key through the portal.

- Access “Payment Providers” in your Shopify account settings.

- Click “Alternative Payments,” select CoinPayments, and insert your details.

If you use WooCommerce…

- Download the CoinPayments extension through WordPress.

- Upload the CoinPayments directory to your WordPress directory.

- Activate the plugin on your WordPress plugins page.

- Enable CoinPayments.net in your “Payment Gateways” tab on WooCommerce.

- Insert your merchant ID and IPN Secret Key.

If you use Magento…

- Create a CoinPayments business account.

- Log in to your Magento Admin panel and go to Magento Connect Manager.

- Paste the CoinPayments extension URL and install.

- Locate the CoinPayments extension in “Payment Methods.”

- Enable and configure the Coinpayments extension for Magento.

If you use something else…

We have custom solutions, too! To explore all of our features and find the right fit for your business, your first step is to register for a business account on CoinPayments.