At CoinPayments, ensuring the security and compliance of our platform is a top priority. We require all users to complete Identity Verification to achieve this. This process helps us meet regulatory requirements and protects our users from potential fraud and financial crimes.

To streamline the verification process, we’ve partnered with leading verification platforms, SumSub and RiskScreen (now KYC360), trusted by top financial institutions worldwide. These platforms fully comply with GDPR and other data protection regulations, ensuring your information is secure and private.

We understand that verification can sometimes be daunting, so we’ve designed a simple, tiered approach that applies to all users, whether you’re an individual or a business. Our verification process is straightforward and user-friendly, allowing you to start transacting quickly while providing additional verification as your activity on the platform grows.

In this tutorial, we’ll guide you through the different verification tiers, explaining the requirements and benefits at each level. We’ll also demonstrate how to contact support if you encounter any issues.

Let’s get started.

Verification Tiers

For “Total Transaction Volume,” we count payments, deposits, withdrawals, and transfers towards the volume limits. This includes all transactions performed on the user interface or through API activity, regardless of the cryptocurrency used, as long as it has a positive Bitcoin exchange rate (AnyCoin/BTC) and is supported for each transaction type.

Please note that we may dynamically adjust the verification requirements for each Level or account type based on global AML/CTF and counterparty risk requirements (e.g., travel rule) and local compliance policies (e.g., reporting and licensing). This means that not all KYC sections will apply to every user, as the requirements may vary depending on individual circumstances and the ever-changing regulatory landscape.

Tier 1: Basic Verification

To start using the CoinPayments platform, all users must complete our Basic Verification process, also known as Tier 1. This initial verification is designed to be quick and easy, allowing you to start transacting with minimal hassle.

By completing this tier, you can:

- Transact up to $20,000 USD in lifetime volume, including deposits, withdrawals, and API activity.

- Access basic features of the CoinPayments platform.

To progress to the next tier and unlock higher transaction limits and additional features, you will need to provide additional information and complete further verification steps, which will be covered in the Verification Requirements section of this guide.

Tier 2

When your total transaction volume exceeds $20,000 USD (including deposits, withdrawals, or API activity), you’ll be required to complete Tier 2 verification. This tier is designed for users needing higher transaction limits and additional features.

By completing Tier 2 verification, you can:

- Transact up to $100,000 USD in lifetime volume, including deposits, withdrawals, and API activity.

- Continue using the CoinPayments platform without any payment limitations up to the Tier 2 volume limit.

To progress to the next tier and unlock even higher transaction limits and additional features, you will need to provide further information and complete the necessary verification steps, which will be covered in the Verification Requirements section of this guide.

If you have any questions or encounter issues during the Tier 2 verification process, please contact our support team by following the steps in the “Resolving Identity Verification Issues” section at the end of this page.

Tier 3

When your total transaction volume exceeds $100,000 USD (including deposits, withdrawals, or API activity), you’ll be required to complete Tier 3 verification. This tier is designed for users with significant transaction volumes who require higher limits and access to advanced features.

The system will automatically activate payment limitations, and you’ll need to pass Tier 3 verification to lift these limits.

By completing Tier 3 verification, you can:

- Transact up to $1,000,000 USD in lifetime volume, including deposits, withdrawals, and API activity.

- Continue using the CoinPayments platform without any payment limitations up to the Tier 3 volume limit.

- Access advanced features and benefits tailored for high-volume users.

After successfully completing Tier 3 verification, a banner will be displayed on your Dashboard, informing you about the option to upgrade to a Business/Corporate Account or remain a Personal Account. This choice allows you to select the account type that best suits your needs and requirements.

To progress to the next tier and unlock even higher transaction limits and additional features, you will need to complete the necessary verification steps, which will be covered in the Verification Requirements section of this guide.

If you have any questions or encounter issues during the Tier 3 verification process, please contact our support team by following the steps in the “Resolving Identity Verification Issues” section at the end of this page.

Tier 4

Advancing to Tier 4 requires a manual verification process, which begins with your request to update your account to either a Corporate or Personal account. This tier is designed for users who need to operate at a higher level and require tailored verification to meet their specific needs.

Should you choose to maintain a Personal account, you’ll be subject to a transaction limit of $1,000,000 USD. If you require higher limits or additional features, you may need to consider upgrading to a Corporate account.

By completing Tier 4 verification, you can:

- Operate your account as Corporate or Personal, depending on your business needs and structure.

- Access features and benefits specific to your chosen account type.

- Transact up to $1,000,000 USD in lifetime volume for Personal accounts, with the potential for higher limits for Corporate accounts.

To initiate the Tier 4 verification process, you will need to submit a request to our support team indicating your preference for a Corporate or Personal account. Our compliance team will then review your request and guide you through the necessary steps to complete the verification process.

Once our compliance team has reviewed and approved your request, your account will be updated to the selected type (Corporate or Personal), and you’ll gain access to the corresponding features and benefits.

If you have any questions or require assistance during the Tier 4 verification process, please contact our support team by following the steps in the “Resolving Identity Verification Issues” section at the end of this page.

Tier 5

Tier 5 verification is the highest verification level available on the CoinPayments platform, designed for users with substantial transaction volumes and specific business requirements.

This tier is divided into two distinct paths, depending on whether you are a Personal or Corporate account.

If you are a Personal account in Tier 4 and your total transaction volume has reached the $1,000,000 USD limit (including deposits, withdrawals, or API activity), you will be required to complete Tier 5 verification. This enhanced due diligence process is necessary to remove the transaction limit and ensure uninterrupted access to your account.

By completing Tier 5 verification as a Personal account, you can:

- Remove the $1,000,000 USD transaction limit and continue using your account without disruptions

- Access personalised support and benefits tailored for high-volume Personal accounts

- Maintain your status as a Personal account while operating at a higher level

To complete Tier 5 verification as a Personal account, you will need to provide additional information and documentation, as specified in the Verification Requirements section of this guide. Our compliance team will review your submission and work with you to complete the enhanced due diligence process.

Upon successfully approving your upgrade request, you will receive email confirmation, and the transaction limits on your Personal account will be removed.

However, Corporate accounts will need to complete the Know Your Business (KYB) process through our partner, RiskScreen (now KYC360), to achieve full approval. This process is essential to ensure compliance with international regulations and maintain the security of our platform.

To complete verification as a Corporate account, you will need to follow the KYB workflow through RiskScreen (now KYC360), as outlined in the later section of this guide. Our compliance team will assist you throughout the process and ensure a smooth experience.

If you have any questions or require assistance during the Tier 4 verification process, please contact our support team by following the steps in the “Resolving Identity Verification Issues” section at the end of this page.

Verification Requirements

To ensure the security and integrity of our platform, we require our users to complete various verification steps. These requirements help us comply with global regulations, prevent fraudulent activities, and maintain a safe user environment.

In this section, we’ll guide you through the different verification requirements, providing detailed instructions and tips to help you complete each step successfully.

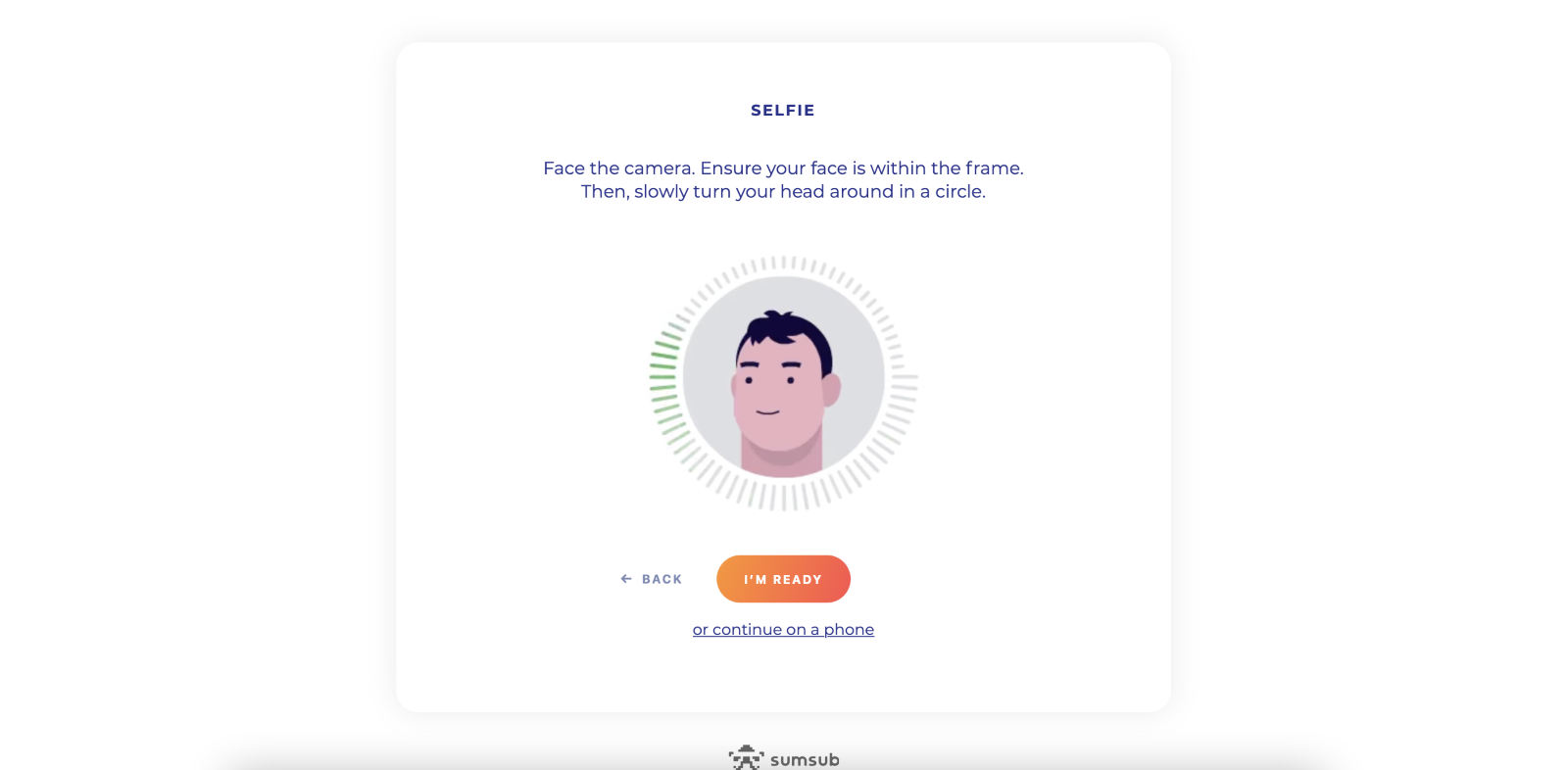

Selfie Verification

We require users to submit a live selfie as part of our identity verification process. This step helps us confirm that the person creating the account is the same as the individual depicted in the provided identity documents.

To properly take and submit a selfie for verification, follow these guidelines:

- Ensure that you are in a well-lit area with a plain background.

- Hold your device at eye level and look directly into the camera.

- Remove any hats, sunglasses, or other accessories that may obscure your face.

- Make sure your face is fully visible and not covered by hair or hands.

- Maintain a neutral facial expression and keep your mouth closed.

- Capture the selfie and review it to ensure it meets the above criteria.

Simply face the camera and make sure your face is within the frame. You can also continue the KYC process on your phone by clicking the “Continue on phone” link.

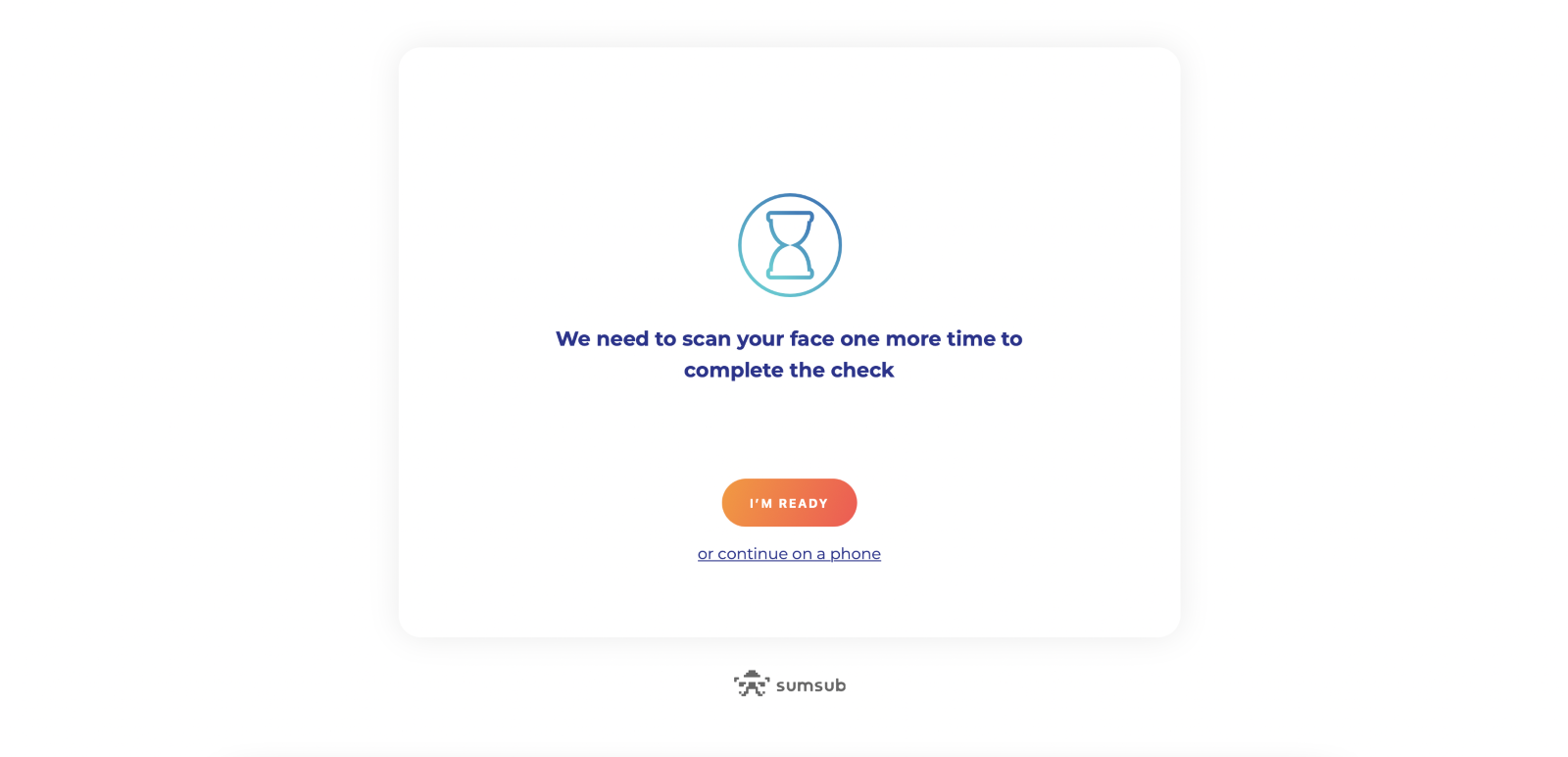

If the camera doesn’t capture your image properly, you might see this page:

After completing the selfie step, you will see a confirmation screen indicating that you have completed the requirements:

If your selfie is rejected, review the provided feedback and retake the selfie following the guidelines above. If you continue to face issues, contact our support team for assistance.

Phone and Email Verification

To enhance the security of your account and ensure that we can communicate with you effectively, we require users to verify their phone number and email address.

Tips for a successful phone and email verification:

- Double-check that your phone number and email address are entered correctly.

- Ensure that you have access to the phone number and email address provided.

- A virtual phone number or a disposable email address may not be accepted for verification purposes.

- Whitelist the CoinPayments email address to prevent verification emails from being marked as spam.

Completing phone and email verification helps protect your account from unauthorised access and ensures you receive important communications from our team.

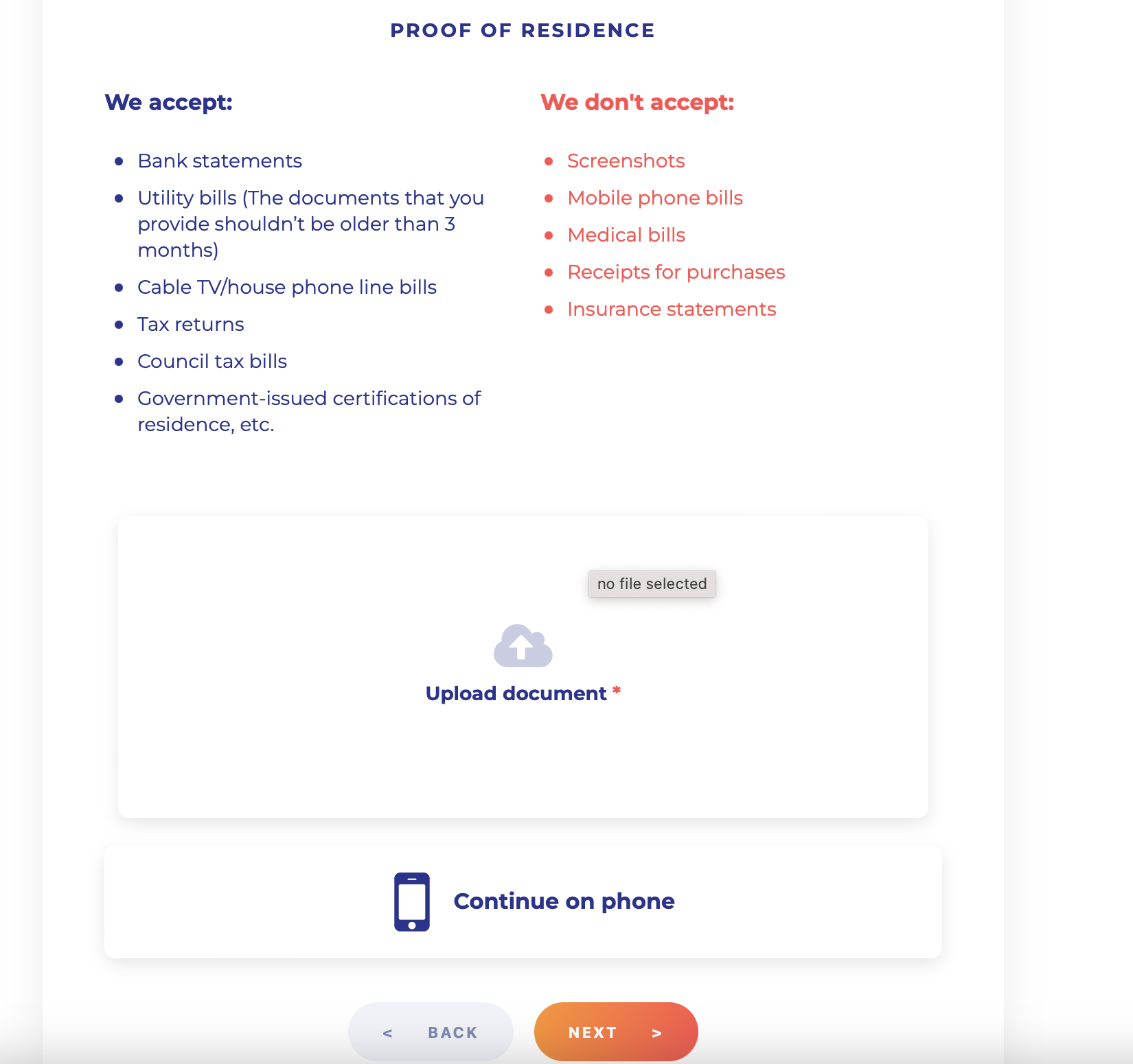

Proof of Address (POA)

As part of our verification process, we require users to submit a valid Proof of Address (POA) document. This step helps us confirm your residential address and comply with regulatory requirements.

To submit your Proof of Address (POA), please provide one of the documents listed on the following screen:

Please ensure that your Proof of Address (POA) document meets the following criteria:

- The document must be issued within the last 3 months.

- Your full name and residential address must be clearly visible.

- The document must be in a format that cannot be easily altered, such as a PDF or a clear photograph.

Once you’ve submitted your Proof of Address (POA), our team will review your document and email you as soon as the verification is complete.

If your Proof of Address (POA) is rejected, you’ll receive an email with the reason for the rejection and instructions on resubmitting a valid document.

If you have questions or encounter issues while submitting your Proof of Address (POA), please contact our support team for help.

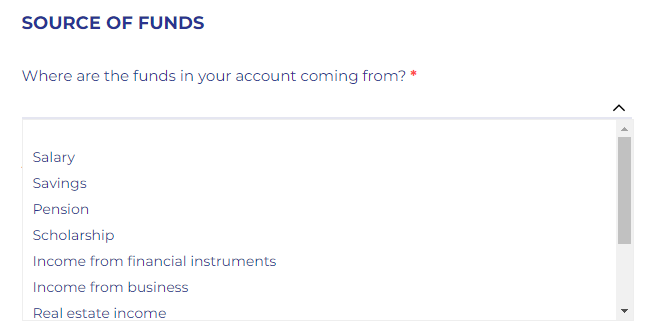

Source of Funds (SOF)

Source of funds (SOF) refers to the origin of the money used in a particular transaction. As part of our commitment to maintaining a secure and compliant platform, we require users to provide information about their SOF during verification.

When completing the Commercial Questionnaire or the Account Upgrade for Merchants Questionnaire, you will be asked to specify your Source of funds (SOF) from among the following options:

- Revenue

- Securities

- Royalties/Dividends from Branches

- Financial Support from State/International Bodies

- Loans/Credits

- Crypto Currency Trading/Mining

- Real Estate

- Investments

- Other (please indicate)

Please select the option that most accurately represents the primary source of the funds you will use to perform transactions on the CoinPayments platform.

If your Source of funds (SOF) is not listed among the available options, please choose “Other” and provide a brief explanation.

Providing accurate information about your Source of funds (SOF) is crucial for maintaining the integrity of our platform and complying with regulatory requirements.

If you have multiple sources of funds, please select the most significant or relevant one. In some cases, our compliance team may request additional documentation to verify your Source of funds (SOF).

For business accounts (Merchant accounts), you will be required to provide information about your company’s source of funds. This may include revenue from sales, investments, loans, or other business-related income.

Please contact our support team for guidance if you have any questions or concerns about providing your Source of funds (SOF) information.

Commercial Questionnaire

As part of our verification process, you are required to complete a questionnaire. This questionnaire is designed to gather essential information about you and your business.

Completing the Commercial Questionnaire is a critical step in the verification process and by providing the requested information, you demonstrate your commitment to transparency and help us maintain a trusted, compliant platform for all our users.

Please ensure that all information provided in the Commercial Questionnaire is accurate, complete, and up-to-date. Our compliance team will review the submitted questionnaire and may request additional documentation or clarification if needed.

If you have any questions or concerns while filling out the Commercial Questionnaire, please contact our support team for help.

Upgrading to a Corporate Account

If you’re a business or merchant requiring higher transaction limits, additional features, and enhanced support, upgrading to a CoinPayments Corporate account might be the right choice.

Benefits of upgrading to a Corporate Account:

- Higher Transaction Limits: Corporate accounts have access to significantly higher transaction limits compared to Personal accounts, allowing you to process larger volumes of payments and transfers.

- Dedicated Support: As a Corporate account holder, you’ll receive priority support from our dedicated team of experts, ensuring that your inquiries and issues are addressed promptly.

- Customised Features: Corporate accounts can access tailored features and integrations designed to streamline payment processing and reporting for businesses.

- Reduced Fees: In some cases, Corporate accounts may be eligible for reduced transaction fees, helping you save money on your payment processing costs.

KYB (Know Your Business) – Step-by-Step Guide

To upgrade to a Corporate account, you need to go through our KYB verification process. KYB is mandatory and ensures CoinPayments complies with financial regulations and reduces risks to its clients. It involves verifying the identity of business entities, assessing their reputation, and evaluating potential risks.

By conducting KYB checks, businesses can protect themselves against financial losses, legal penalties, and reputational damage.

To initiate the KYB process, follow these steps:

Step 1

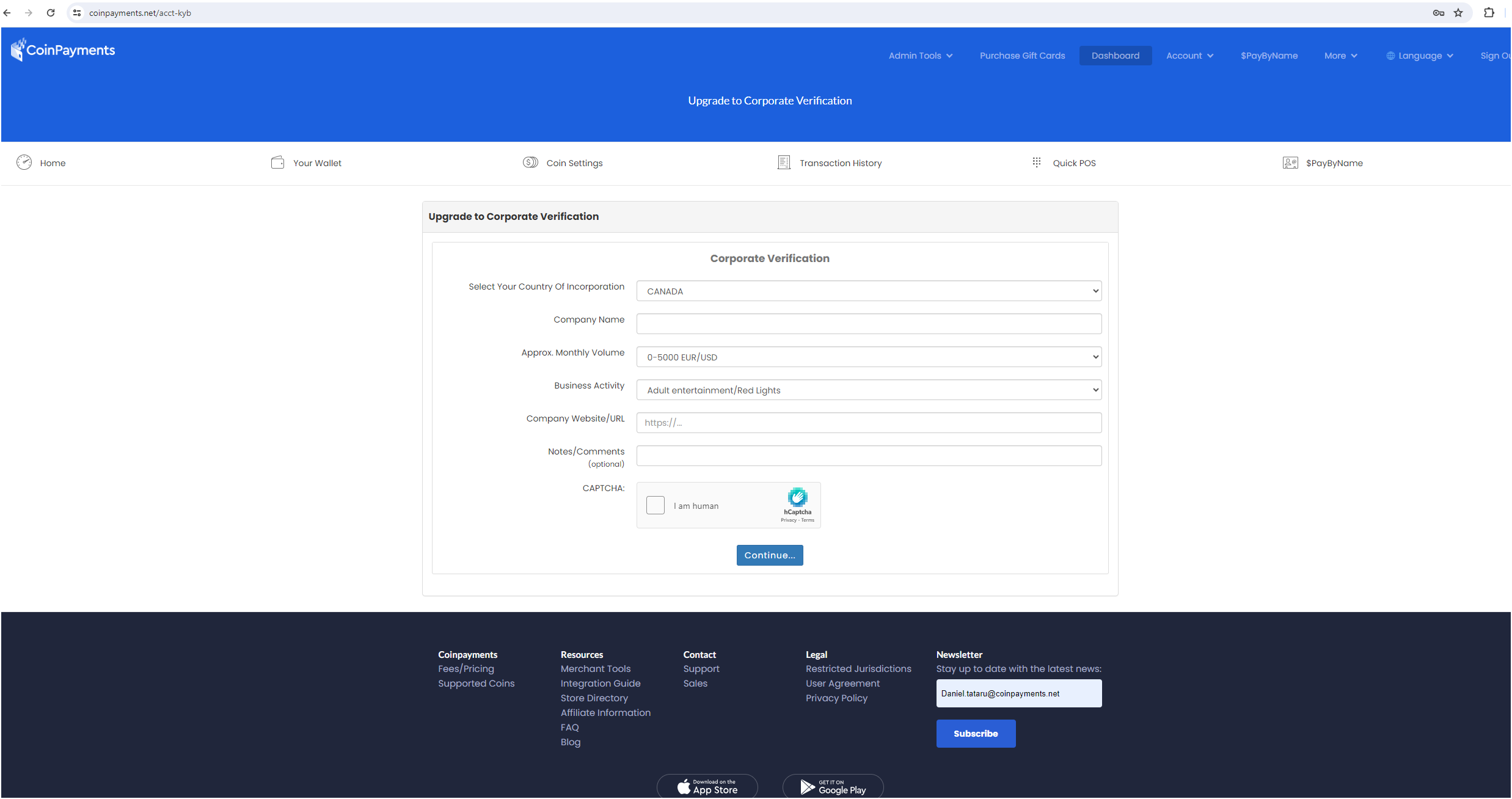

To start your KYB process, please visit https://www.coinpayments.net/kyb and click on the “Upgrade to a Corporate account” button.

Fill out the form.

After filling out the form, our compliance team manually reviews your entry and schedules a call to discuss the benefits of upgrading. If you decide to proceed, a link to start verification with our partner RiskScreen (Now KYC360) will be emailed to you.

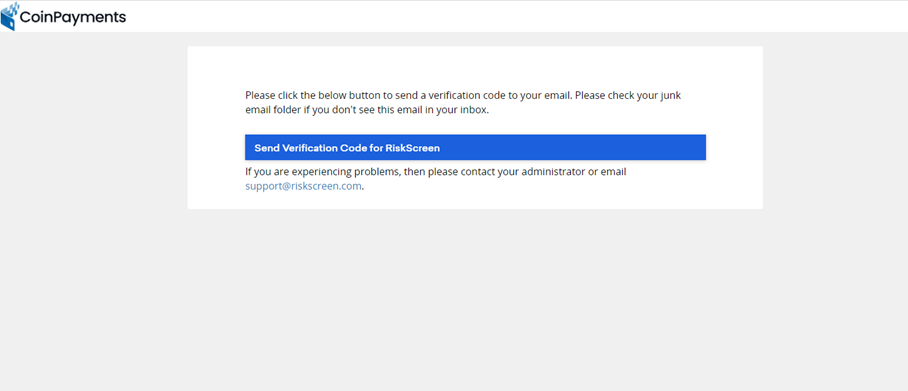

Step 2

Click “Send Verification Code for RiskScreen (Now KYC360)“, you will receive a unique verification code in your registered email inbox. This code is required to proceed with the Know Your Business (KYB) process through our partner, RiskScreen (Now KYC360).

You should have received an email containing a unique verification code. This code serves as a two-factor authentication (2FA) measure to ensure the security of your account and the KYB process.

Please check your registered email inbox for the verification code. The email containing the code will be sent to the same address you used to create your CoinPayments account.

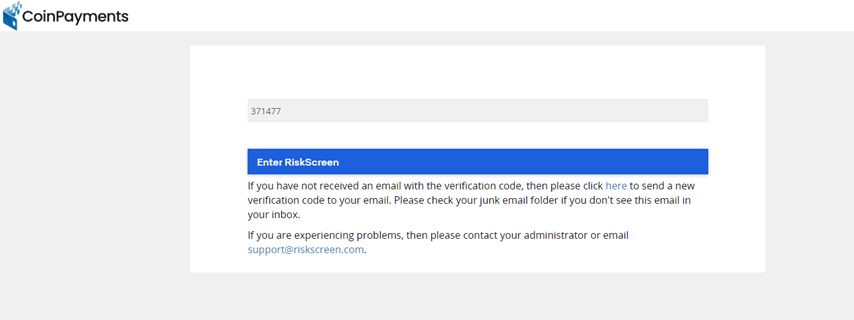

Once you have located the email with the verification code:

- Enter the code in the designated field.

- Click “Submit” or “Verify” to proceed with the KYB process.

Please note that the verification code is unique for each request and will expire after a short period. The code shown in the image, “371477”, is for reference only and will not work for your specific verification.

If you haven’t received the email with the verification code, please:

- Check your spam or junk mail folder.

- Wait a few minutes, as there may be a slight delay in receiving the email.

If you still haven’t received the code, click on “Send a new verification code” to request a new one.

If you continue to experience problems receiving the verification code, please contact the CoinPayments support team for further assistance.

Once you have successfully entered the verification code, you will be able to proceed with the KYB process.

Step 3

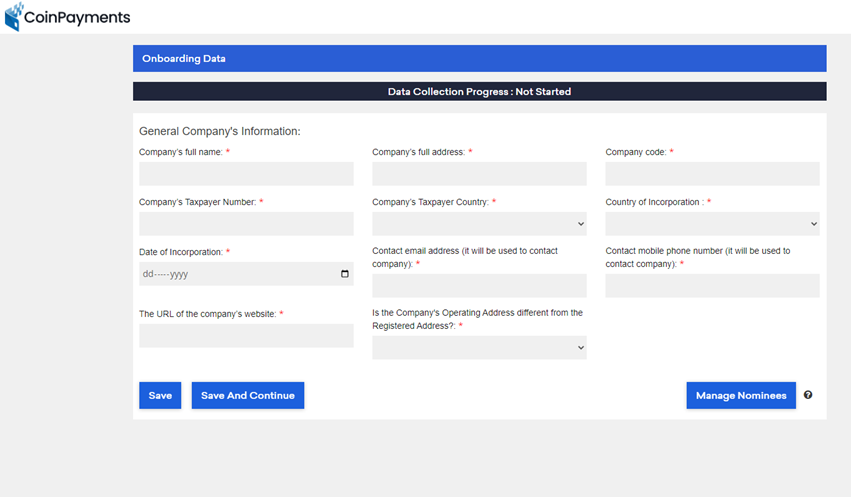

After receiving the verification code from your registered email, provide the required general, personnel, business, and financial information, including details of authorised persons, directors and ultimate beneficial owner(s).

Disclose political exposure and complete KYC steps for each Director or UBO.

Sign to confirm the data submitted by your company/team is authentic.

Step 4

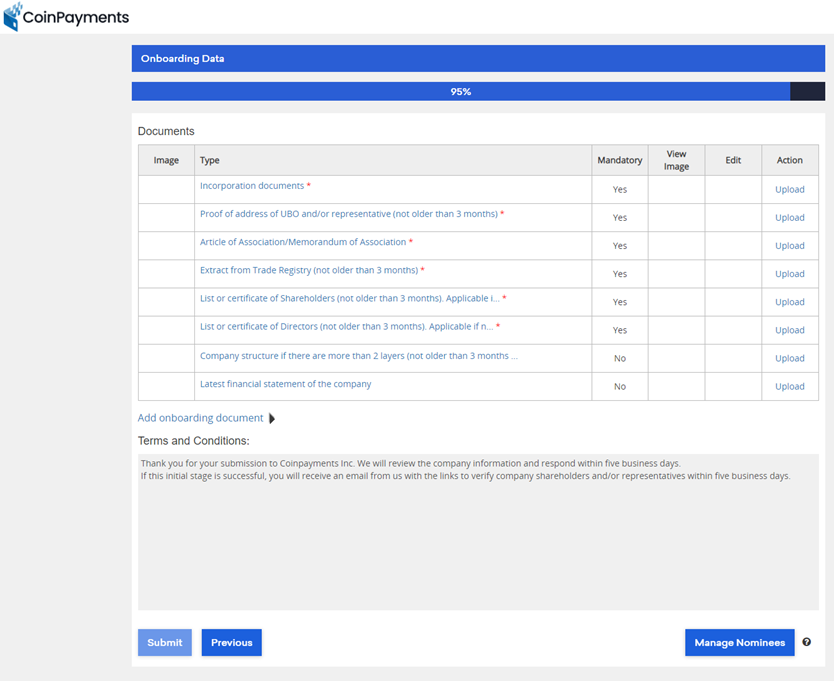

As part of the KYB process, you will be required to upload valid documents that are no older than three months and in English. These documents help us verify your business’s identity, structure, and financial standing. Please ensure that you have the following documents ready for upload:

- Incorporation documents

- Proof of address of UBO and/or representative (not older than 3 months)

- Article of Association/Memorandum of Association

- Extract from Trade Registry (not older than 3 months)

- List of certificate of shareholders (not older than 3 months)

- List of certificate of Directors (not older than 3 months)

- Company structure if there are more than 2 layers (not older than 3 months)

- Latest financial statement of the company

Please note that the documents marked with an asterisk (*) are mandatory, while the others may be applicable depending on your company’s structure and jurisdiction.

When preparing your documents for upload, ensure that they meet the following criteria:

- All documents must be valid and up-to-date and issued within the last three months.

- Documents must be in English. If your original documents are in another language, please provide a certified English translation.

- Scans or photographs of documents must be clear, legible, and complete. Low-quality or partial images may delay the verification process.

Step 5

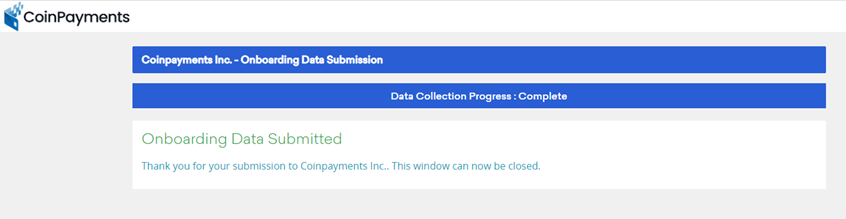

After uploading your documents successfully, you’ll see a “Data Collection Progress – Complete” notification.

This screen confirms that your information and documents have been submitted for review. At this point, you may safely close the window.

Note: If additional documents are needed based on your company’s country of incorporation, region, or ownership structure, we will promptly request them to expedite the onboarding process. If your submission meets our initial requirements, you will receive an email with links to verify company shareholders and/or representatives.

Step 6

After your merchant account has been reviewed and approved, you will receive an email informing you about your account status and providing further instructions.

In the email, you will find KYC links for each of your company’s Directors and Ultimate Beneficial Owners (UBOs). Each Director and UBO must successfully complete and pass the KYC process for your merchant account to receive final approval.

If any Director or UBO fails to pass the KYC process, your merchant account will also be rejected. Therefore, it is crucial that all Directors and UBOs complete their KYC verification promptly and accurately.

Once all Directors and UBOs have successfully passed their KYC verification, your merchant account will receive final approval, and you will be notified via email.

If you have any questions or concerns about the Director/UBO KYC process or your merchant account status, please contact our support team for help.

Resolving Identity Verification Issues

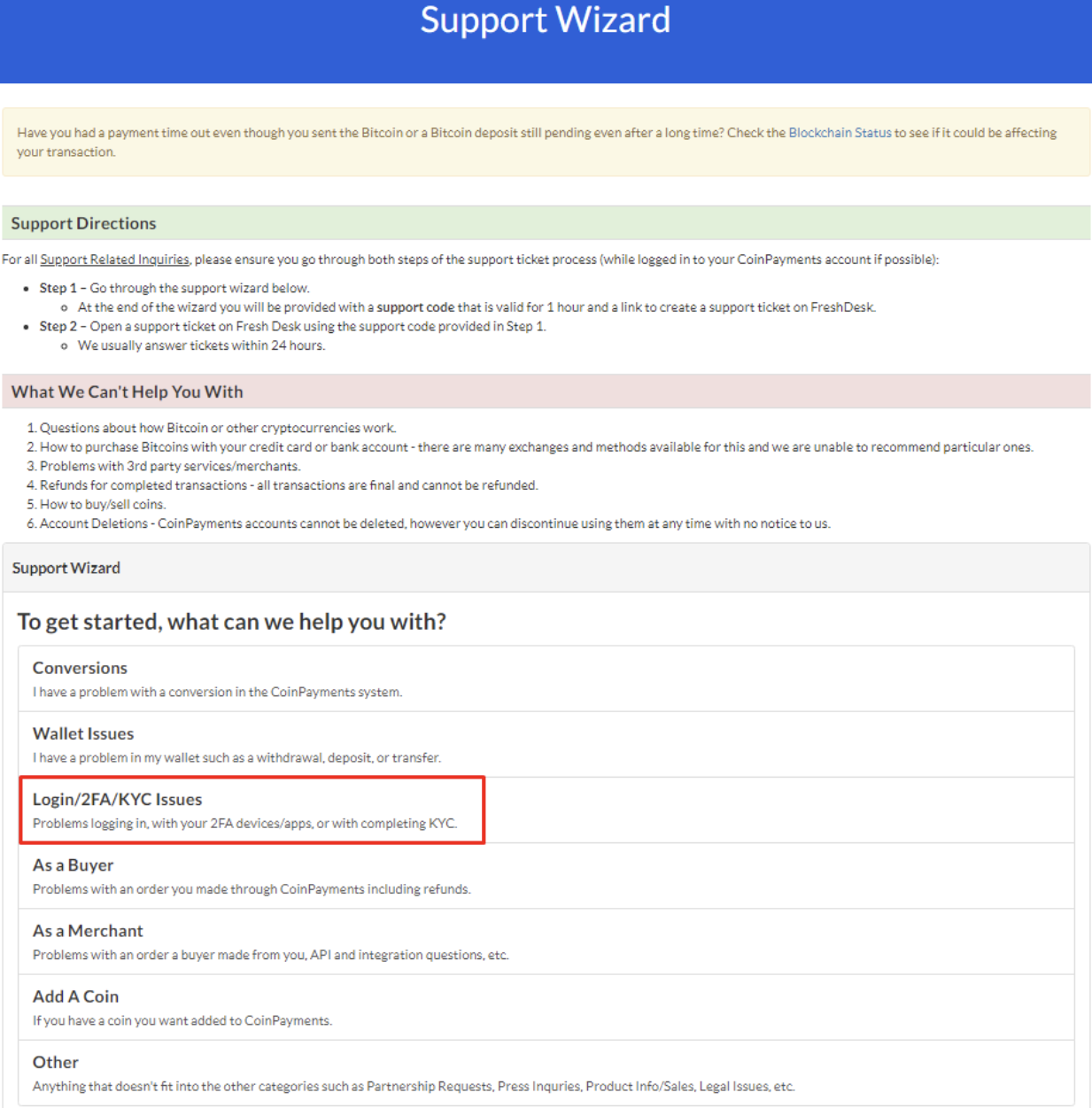

If you encounter any issues with identity verification, such as the upload of unsupported documents or poor quality of submitted files, and the problem cannot be easily resolved through your verification dashboard, please follow the steps below to contact our customer support team for assistance.

Step 1

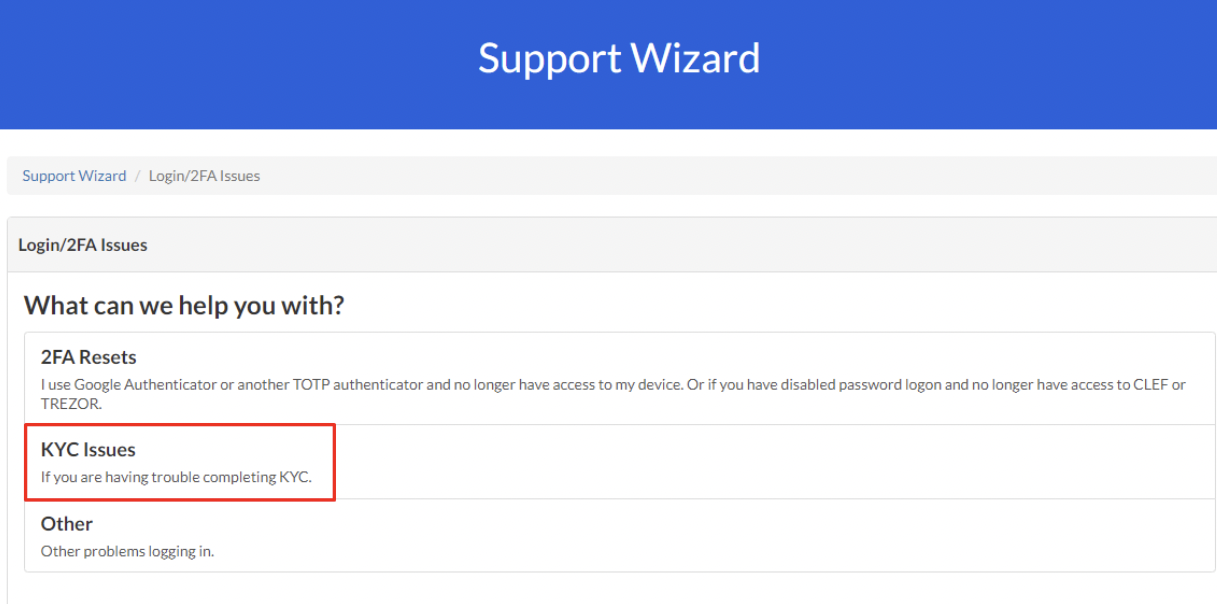

Go to https://www.coinpayments.net/supwiz and select “Login/2FA/KYC Issues” from the Support Wizard’s issue categories.

Step 2

Click on “KYC Issues” to proceed to the next step.

Step 3

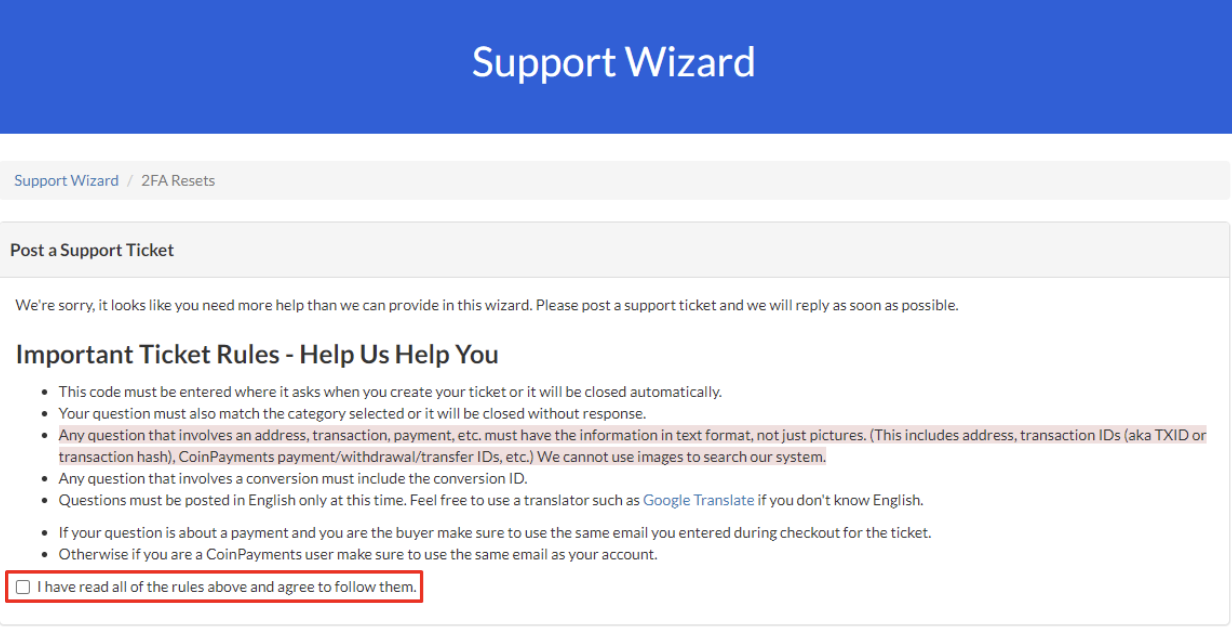

Read and confirm your agreement to the support rules by checking the box provided.

Step 4

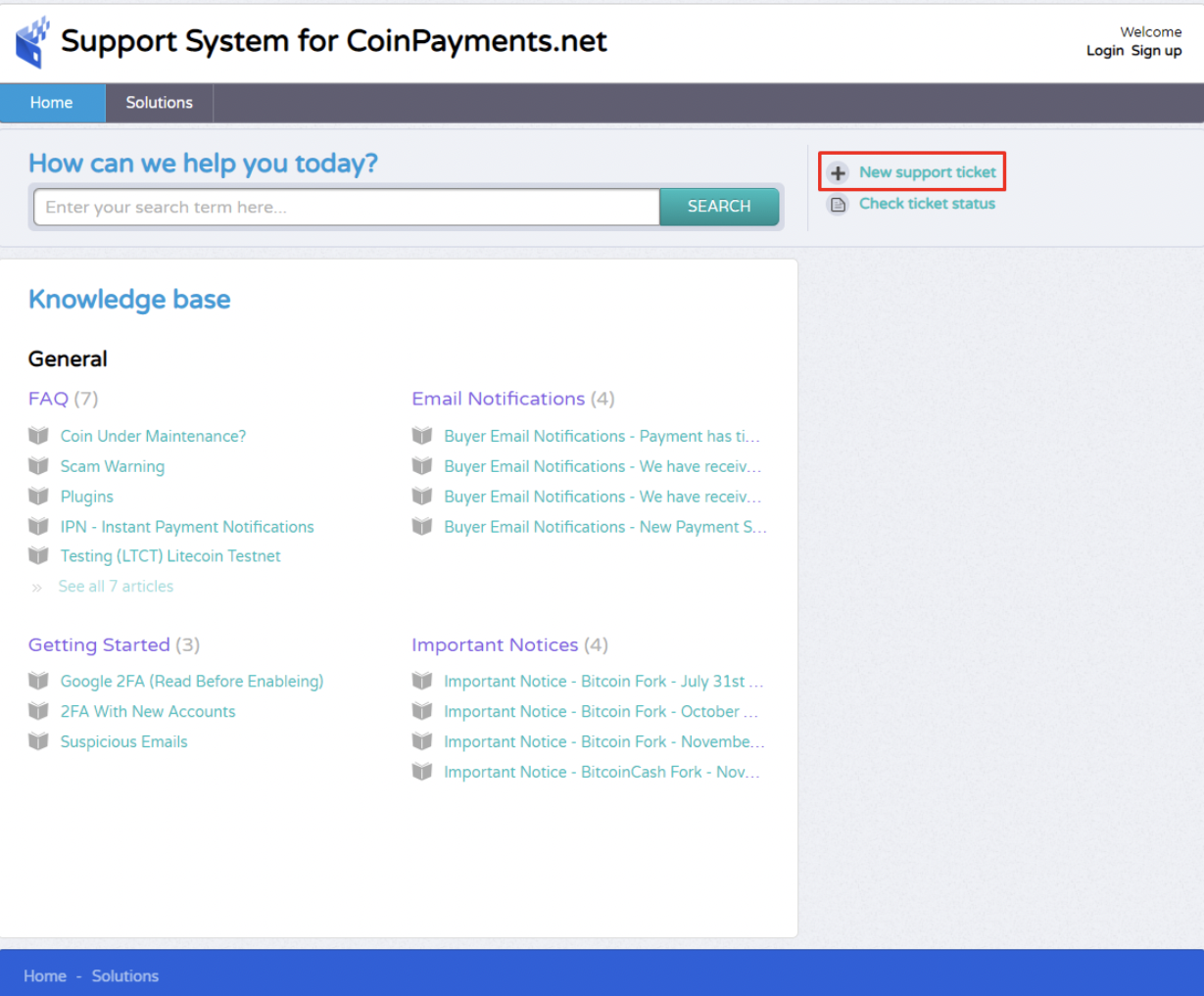

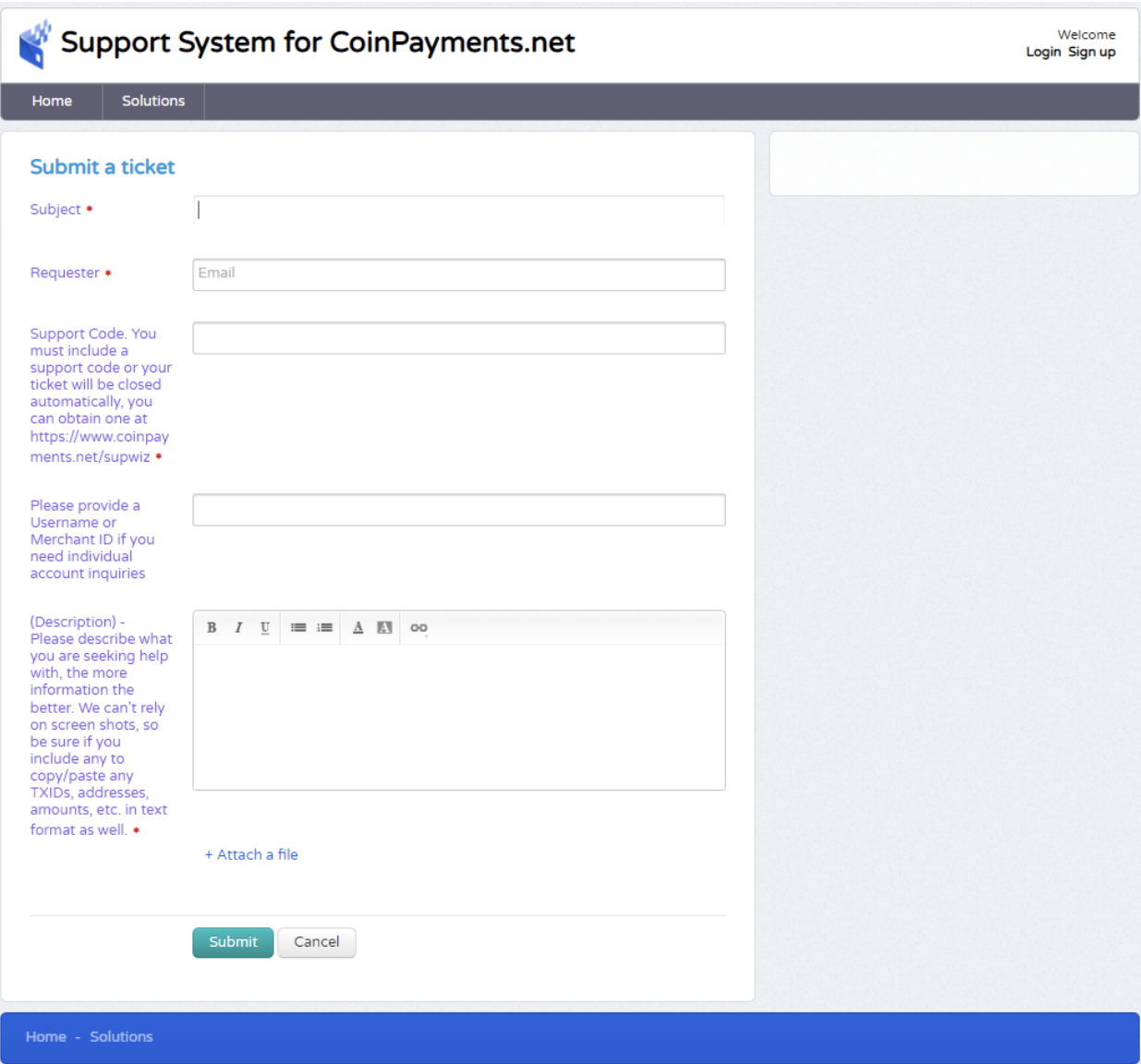

After agreeing to the support rules, copy the support code generated by the system. You will need this code when creating a new support ticket at https://coinpay.freshdesk.com/

Fill out the support form with details about the issues you have and attach any relevant files or images. Make sure to include the support code you copied in Step 3.

Once your support ticket is submitted, a customer support representative will contact you to assist with resolving your account verification issue.

If you haven’t begun your KYC process yet, please log into your account at https://www.coinpayments.net/login to get started.

Our support team is dedicated to helping you resolve any identity verification issues you may encounter. We appreciate your cooperation and understanding throughout the verification process.

If additional documents are needed based on your company’s country of incorporation, region, or ownership structure, we will promptly request them to expedite the onboarding process. If your submission meets our initial requirements, you will receive an email with links to verify company shareholders and/or representatives.